A business approach to buying a motorhome

Motorhomes can cost as much as a house and depreciate like a car. So why would anyone in their right "economic" mind purchase one? Surprisingly, for many folks, it's a very reasonable decision, but one that's often not discussed or looked at correctly from a business analysis perspective. In my four decades as an entrepreneur who has built several successful companies, I've used many of the same business techniques to evaluate personal purchase decisions. This article will give you some insight into the financial process I used in deciding to purchase our motorhomes and provide some perspective of the unique economics of RV ownership.

The big disclaimer here is, "your actual experience may vary!" I understand that there's a world of variables between different budgets, travel styles, risk tolerance, and lifestyle goals. However, I've found that while much is aways written about the joys and romance of mobile travel, few rarely discuss the economic side of the equation.

What's the one big difference between a business and personal purchase decision? Profit. This is at the core of every business decision. It's the expectation that for every one dollar you put in you will realize a return of at least one-plus back. However, a personal lifestyle decision needs to be measured against a different matrix of factors: emotional satisfaction, comparability of cost, proportionality of risk, and exit strategy.

Emotional satisfaction

This is the biggest driver in any RV purchase decision. When standing in a coach at an RV show or eyeballing a fancier rig parked next to you at the campground, our minds easily go to the romance of spending more time on the road, or having a little more elbow room with a large screen TV to watch the big game under the shade of palm trees. There is absolutely nothing wrong with spending money on fun, comfort, or for that matter, luxury. But sometimes (and I can be just as guilty as the next fellow) emotion can overpower logic and that's where things can get sticky.

The best test of an emotionally based decision is to quantify how and where you'll plan to use your rig. How many days or months out of the year? Will it replace other travel plans by sucking up other vacation dollars? Be realistic in your assessment. As humans, we generally go down a predictable path learned in childhood where we are obsessively focused on a new toy and, after time, move on. That's okay with a Tonka Truck, but can be quite costly if you're upsizing or downsizing a motorhome. Think ahead to after you've checked off big trip goals like Alaska or Nova Scotia, where, and how often you'll use your rig.

While not as unpleasant as estate planning, you owe it to yourself to also evaluate your decision over time. Generally, the economic usefulness of your new or used RV will be in the 7-10 year range. If you're in your mid-60's your physical health and vitality may be a factor that you would never have considered in your 40's. Surprisingly, the thought of future grandchildren can either seal the deal if they're far away and you plan to visit them often or keep you off the road if they're close to home. If you're in your 20's or 30's it's a highly reasonable to expect that you'll have several life changes ahead from career changes to parenthood. So from that standpoint, you'll want to be thinking about timeframes, flexibility, and exit strategy.

Comparability of cost

There are many ways you can and should look at cost. Most RV owners use their rigs part time. The financial mechanics for full-time RVers is different and if that's your consideration you'll find a lot of people who have shared their experiences and finances on the web. This article is more tailored to part-time travelers.

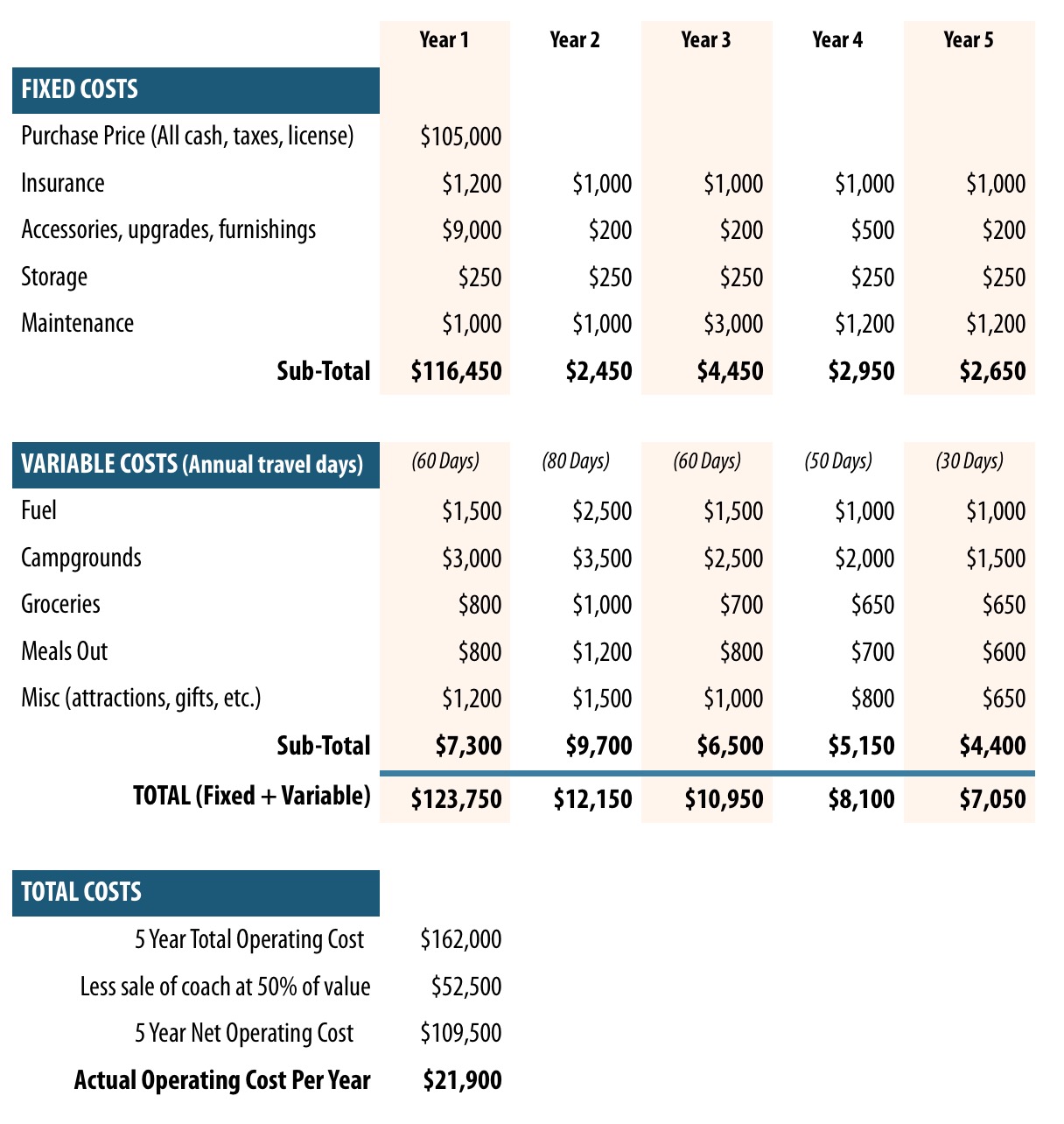

Early on in any big financial endeavor, I start with a spreadsheet, but even a low-tech legal pad will do. I start with some general assumptions. For this particular financial model here's my scenario:

- Purchase new

- Traveling without kids

- A big trip in years one and two

- Batteries and tire replacements in year three

- Scaled back travel in year five

- Sell rig in five years for half of what it cost

I then build a grid:

Of course, fixed costs will be different for everyone depending on the model of your coach, storage, and accessories. And while everyone's variable costs can be, well. . .variable, there are some rough guidelines you can use in calculating your daily travel cost.

For simplicity, this model assumes a cash purchase. Many RV owners prefer to finance, so if you do, you'll need to take that additional monthly cost into account. One small benefit to financing is that, depending on your tax situation, you may be able to deduct the interest on your RV loan just like you would a mortgage on a second home. As I said, it's a small benefit that may not even be worth the trouble to itemize on your return, but it's certainly a savings opportunity you should keep in mind.

If you're a frugal traveler who generally prepares all your meals, sometimes dry camps, stays in lower cost state parks or mid-tier commercial campgrounds, your average daily operating cost (fuel, food, hookup) will be in the neighborhood of $70 per day. Avid boondockers can probably push that down to under $50.

If you seek out more luxurious and amenity- rich RV parks, eat out more frequently, spend additional dollars on satellite radio/TV services, have a higher cell phone bill for data services, and go to movies, clubs or stage performances while traveling, your average daily operating cost will be about $125 - $150 per day.

The true "bottom line" in the above spreadsheet scenario is that, over a period of 5 years, your travel adventures would cost you $21,900 a year. Bear in mind that this plan assumes an average of nearly two months of travel per year.

Now let's compare that cost to a one-week Caribbean cruise for two with airfare: $3,000. A two-week domestic car trip with hotels and restaurants $2,000. A moderately priced two week trip to Europe: $10,000, or a more exotic three-week trip to New Zealand, Africa or China: $20,000.

But remember, the biggest difference in these comparisons is that their durations are much shorter. When someone says that traveling in an RV is one of the least expensive forms of travel, when you reduce it to a daily operating cost, it absolutely is!

And how does RV ownership compare to owning a second home? No matter how you look at it, RV ownership will probably come out on top. I won't try to confuse things with a timeshare or fractional ownership options, but if we're comparing an RV purchase to buying a resort property you have to look at the components of the real estate purchase. Assuming you take out a mortgage there will be a minimum 20% downpayment. If it's a condo, there will be HOA fees. If it's a single family structure you probably will spend some money with an occasional property manager and exterior maintenance. Of course, there will be opportunities to rent it out (if you want) to defray operating costs, but often the best rental times of the year are also the times you'd like to use the property. And, I know from running the Economic Council in the Vail Valley for ten years, that even some of the most coveted real estate in the world is not immune to devaluation. Furthermore, while there can be an upside in real estate appreciation, there are the downsides of illiquidity and sales commissions which can wipe out gains.

Some of our friends own second homes and think of their RV as their third home. It's all about what your interests, budget and risk tolerance are.

Proportionality of risk

Going back to the emotional aspects of a purchase decision that I discussed at the beginning of the article, for the vast majority of middle-aged, middle-class RV buyers, next to our homes, this is probably one of the largest purchases we may make. You're either going to pay cash for your coach or finance a portion of it. If you're on the cusp of retirement and will be paying cash, you want to make sure that the initial decrement of your savings won't harm your reserves and that your income stream from social security, investments, IRA's, etc. can support the variable travel costs you'll incur over time.

If you're younger and are likely financing, you'll want to look carefully at your personal amount of debt service. I've been increasingly talking to the next generation of full-time RVers who have found that the cost of an RV payment, along with park hook-up fees, can compare favorably to rent in larger urban areas.

New versus used. One strategy of mitigating risk is to buy a used coach. That might reduce your front end costs significantly enough to allow you to get a fancier rig, or simply get what you basically wanted for less money. This is a very reasonable strategy especially if you're just not sure if RV ownership is for you. It does lower your risk, but your variable travel costs will most likely be the same (and maybe a higher with out of warranty maintenance on an older unit). And while your front end expense will be less because you're paying a depreciated price, your back end resale price may be lower too, and your net cash return not substantially greater than if you'd bought new.

Financing your motorhome has the upside of preserving your cash and the downside of increasing your monthly outflow. Fortunately, interest rates are pretty reasonable and will probably remain so for the foreseeable future. Financing can be a good option for younger buyers who will be traveling as a family. However, if there's an interruption in cash flow such as a job loss or illness, that monthly payment can quickly become a burden. For a pre or early retiree, financing may be a good strategy of being able to hit the road now while you wait to liquidate another asset like the lakeside cabin or some stocks during a bull market.

No matter how you structure the purchase and operation of your RV you want to take care that your underlying financial situation is strong enough to weather the hit if things, for whatever reason, don't work out with your motorhome dream.

Exit strategy

These were two words I never paid attention to until about half-way into my professional career, but since then, they've infused every big economic decision I've made personally and professionally. Often contemplating the end helps you make better decisions at the beginning. Just like in real estate, some floorplans and designs are more popular than others. That's something you might want to keep in mind. For instance, our travel plans do not anticipate having other family members or kids with us, so we're just interested in a sleeping arrangement for two. However, our Navion has three different sleeping areas which may be attractive to a future buyer who has a family. That expands the pool of buyers and potentially puts you higher on the resale scale.

Just like cars, every time you trade for a new (or used) RV you take a hit on the wholesale to retail spread. For enterprising owners, that difference can sometimes be lessened by selling your rig on your own. But, more often than not, most owners prefer the easier process of trading in a unit at a dealer. If you enjoy changing rigs or are unsure if your unit is sized right to meet your needs, and want to trade up or down in a couple of years, just know that each transaction cycle will, more often than not, diminish your already depreciating equity. Years ago when I bought out one of my car's leases my car broker said, "Now you can drive some equity into it." It's true. In the case of a depreciating asset the strategy of "buy and hold" makes sense. And the best way to feel good about keeping your coach for longer than five years is making sure that, when you buy it, it has as many of the features and bells and whistles you want, so you'll hopefully stay in love with it for years to come.

However, you may be the kind of owner who enjoys the latest and greatest in newer models and wants to trade more frequently. While there's almost always a cost to selling, you can often optimize the economics by trading a unit in while it still has some chassis warranty, looking at dealers and geographies that have a robust used market for your particular kind of coach, and taking advantage of a true discount (not often over-inflated RV show prices that appear to have "amazing" discounts).

If you're switching from one RV to another, then the issue of taxes may arise. It's good to check ahead of time what the taxation rules are as they vary widely from state to state. Tax mitigation strategies, such as buying an RV through a Montana LLC are out there and I've heard, firsthand, from friends both positive and negative stories. Most of us will likely plate our RV in the state where we live. In my home state of Colorado, the rules are pretty simple. If you trade-in, you only pay sales tax on the trade-in difference.

When we decided to buy a new Navion, I put our motorhome up for sale on RV Trader. I had a couple of good offers and, if I had taken one of them I would have gotten more cash, but would have paid full sales tax on the entire purchase amount of our new Navion. I also had a fair trade-in offer from my dealer which would have placed the value of the transaction a few thousand dollars under the private sale/pay full sales tax option. Though more costly, the trade-in option was definitely less of a hassle and reasonably attractive. But, then there was a third option. A good friend of ours was interested in buying our Navion. I agreed to sell it to him for a below market price. It was a good deal for him as he knew he'd be getting a coach in top condition. The real bonus for me is that our dealer charged a $295 fee for handling the paperwork and I saved thousands of dollars in sales tax by only having to pay the difference on the "trade."

Final thoughts

A good way to insulate yourself from second guessing or buyer's remorse is to work the investment and on-going expense numbers hard. Look at it from beginning to end. I have always found that, in doing so, it makes my thinking more realistic and serves as a valuable counterweight to my romantic side. And more often than not, the numbers don't dissuade me from a purchase, rather they help me make a better timed and suited one.

The best economic way to think about any kind of RV purchase is that it's essentially a consumable. Over time you're going to convert its equity into memories and experiences, some of which may prove priceless.

Comments

Comments on this post are moderated, so they will not appear instantly. All relevant questions and helpful notes are welcome! If you have a service inquiry or question related to your RV, please reach out to the customer care team directly using the phone numbers or contact form on this page .