8 Main Costs of Being a Full-Time RVer

8 Main Costs of Being a Full-Time RVer

Consider these RVing expenses & budgeting tips when planning for your RV life.

By: Kelly Laustsen & David Somach

About nine years ago, we started planning to spend fifteen months full-time RVing. We wanted the flexibility to make plans on the go, while having the comfort of a vehicle we could call home. One of our first research topics was how much money we’d need to save to travel that long with no income.

Using a spreadsheet, we created a budget to compare our expenses of living in a home to what we expected to spend on the road. There are lots of online tools available for this, which can even draw from your credit card statements to easily give you a picture of your spending. While you won’t know your RVing expenses for sure until you are on the road, in-depth research and talking with RVers can help to provide the information you need to create a realistic budget.

We think proper planning is key to making full-time RVing a success – especially when it comes to your budget. You might realize it is more achievable than you think, if you are willing to make some lifestyle adjustments!

Main Costs of Full-Time RVing

To help you plan your RVing budget, below are the main types of costs we incur on the road and tips for managing them.

1. RV Insurance

RV insurance is a bit different from auto insurance and worth considering if you live in your RV full-time or use it frequently. It includes elements typically associated with home insurance, like personal property and attachments coverage, vacation liability coverage, full replacement cost, travel expenses coverage, and personal liability insurance. There are lots of options for RV insurance with a huge range of costs and coverage. It’s important to understand what you are getting. We suggest getting a variety of quotes so you can pick what works best for you. RV insurance is a complicated topic, but a quick Google search will lead you to a bunch of great articles with more information.

2. Health Insurance

Since we left our jobs shortly before going full-time in our van, we chose to purchase our health insurance through COBRA, which covers us for 18 months. We also looked at purchasing health insurance through the open marketplace, but found our options were limited when it came to providing coverage out of the urban Oregon network. This meant if we had significant expenses out of state we’d be paying out of pocket.

There are some great resources out there for exploring your health insurance options. As more people turn to full-time RVing the options are increasing. We’ve met other full-timers that purchase private insurance with a very high deductible, a just-in-case safety net. There are also services that provide telehealth consultation and faith-based cost-sharing plans. We recommend assessing what health care needs you anticipate and weighing all of your options to find a plan that works for you. We opted to go with a more expensive option for the peace of mind of having good coverage.

3. Fuel

We estimated our fuel costs for our entire trip by doing a quick exercise in Google maps. We plotted out a rough itinerary using a few stops around the United States and Canada, and then added a buffer to account for side trips. Our van gets between 12-16 miles per gallon, so we could estimate the amount of diesel we’d use during the trip. We realized that fuel would be a big part of our monthly expenses, given how much we like to move around.

The fuel efficiency of your vehicle/RV and pace of travel will have a big impact on how much you spend each month on fuel. Some things we do to minimize fuel costs in our Revel include:

Efficient route planning: The more you plan your route ahead of time, the more you can optimize so you don’t end up doubling back or driving more than you need to.

Using a credit card that provides cash back on fuel: We get between 3% and 5% cash back based on the current rewards offered on our cards.

Using an app to find the lowest priced gas: We use GasBuddy and are always surprised by how much gas prices vary. On long driving days, we plan our fuel stops to take advantage of the best prices.

4. Accommodations

Where you choose to spend your nights has a huge impact on your monthly budget. We picked an RV and designed our setup for easy off-grid boondocking. Our solar panels and the charging we receive from our alternator while driving provide enough power (especially during the summer months) that we don’t need an outlet to plug into.

Our 21-gallon water tank combined with a portable five-gallon jug and several water bottles provides adequate water for several days. We use our outdoor shower (with biodegradable products) and available restrooms as much as possible to minimize filling up our grey tank and cassette toilet.

We can almost always find a free water fill-up and dump station using the app iOverlander and the website sanidumps.com.

Most of our nights are spent on public land or, when that isn’t available, at a Walmart, truck stop, Cabela’s, Bass Pro Shops, or one of the many other locations that welcome RVers overnight. Most of these spots we find on iOverlander or using online maps of land ownership.

Occasionally, we’ll stay in a campground if there aren’t other options, which is mostly when in national parks. We once stayed in an RV park when we wanted to plug in to run our air conditioner. But at around $50 for the night, we considered this a rare and expensive treat.

Some things to remember to keep your accommodation costs low:

- Consider where you’d like to spend your nights when picking your RV. We like to seek out remote boondocking locations on public land, so we’re glad we have 4x4 and a smaller vehicle with good ground clearance.

- Apps like iOverlander are great resources for crowd-sourced information on campsites, dump stations, water fill-ups, laundromats, and more. However, we like to cross-reference land ownership maps (using the app onX Offroad) and public land websites to make sure we are legally camping and not accidentally on land that doesn’t allow public camping.

- Stay on top of your water and grey tank levels so you don’t have to rely on campgrounds or RV parks to fill-up or empty your tanks. We used to wait until our water tank was nearly empty and our grey tank nearly full to find a place to stop, but have learned it is better to take advantage of water fills and dump stations when they are available.

5. Food and drink

How much you spend on food and drink when living in an RV is largely dependent on your lifestyle, just as when living in a house or apartment. We have found that we spend nearly as much on groceries and dining out now as we did before van life. Sometimes we’ll eat out several days in a row if going through a city where we want to try the local food, but we’ll also have long stretches in the woods camping and backpacking where we won’t eat out at all.

Our meals in the van are simpler than at home and generally less expensive. Since the start of the coronavirus pandemic, we’ve stopped eating or drinking out except for the occasional to-go meal, so we are spending less on food than in earlier parts of our trip where we visited a lot of restaurants and breweries.

We try to be intentional with how we spend money on food and drink, using the following strategies:

Plan your meals to avoid food waste and to maximize the time you can go between grocery stops. We have learned to always go into the grocery store with a list so we don’t buy more than we can fit in the fridge. We buy special treats occasionally (like sparkling water or cold brew coffee), but try to keep our shopping mostly to the essentials.

Use grocery apps (like Ibotta and grocery store specific apps) and shop sales to save money.

Decide what meals or drinks out will provide you the most pleasure and save your money for those. We don’t eat out in touristy stops around national parks and instead seek out unique restaurant experiences we couldn’t have at home, like barbeque in Charleston or hot chicken and waffles in Memphis. We love visiting breweries and local ice cream shops, which for us is a key way to experience a new city.

6. Entertainment

We largely hike, bike and backpack in the spring/summer/fall and ski in the winter, so our entertainment costs are low. We bought a National Park Pass at the beginning of the trip which, at 80 dollars, was an incredible deal. The pass also covers national monuments and battlefields, which we make a point of seeking out. For the winter, we purchased a collective ski pass for $650, which made our 40 days of skiing feel very affordable. (See our winter Revel setup here).

We occasionally visit museums in cities, but also love doing our own exploring by bicycle or foot. There are lots of resources online for finding free and low-cost city activities. We typically start with an internet search to find the best local blogs and websites with recommendations. In particular, we like seeking out live music at restaurants and bars and city parks.

7. RV Maintenance/Repairs/Upgrades

We’ve spent very little on RV maintenance and had no significant repairs in the two years we’ve owned our Winnebago Revel. We stay on top of regular service and have only had minor items to deal with, which were covered under our vehicle’s warranty.

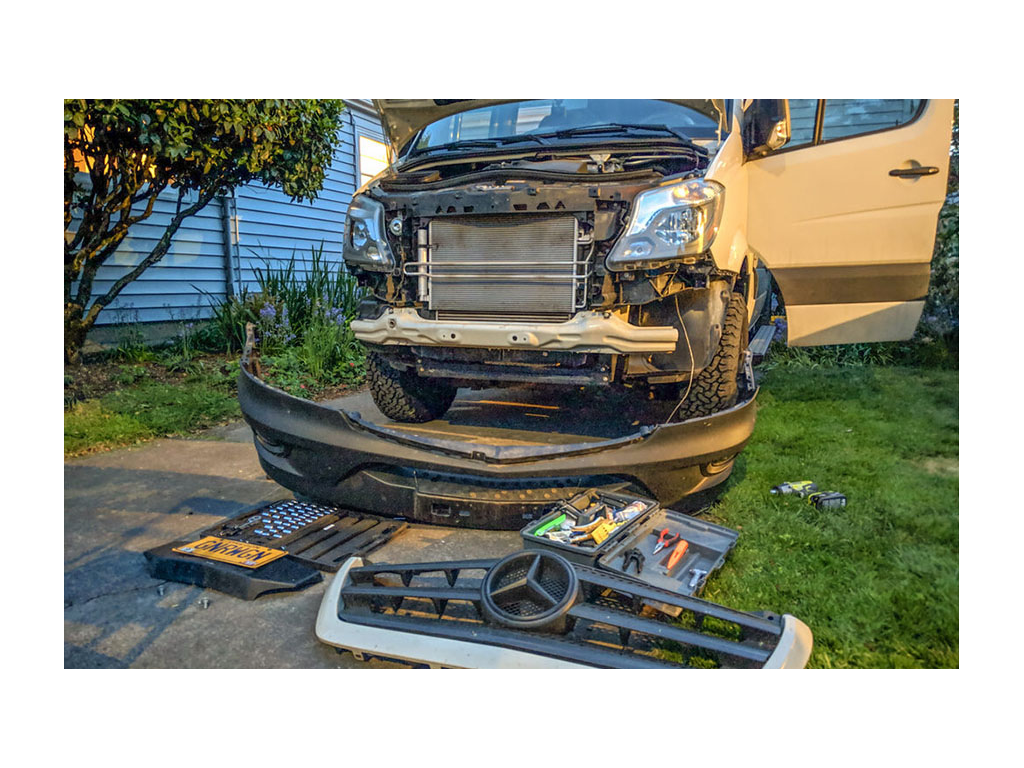

We are always making small upgrades to our Revel to make life on the road easier, such as recently adding an on-board air compressor, in-counter soap dispensers by the sink, and a stool and shower-head holder for outdoor showering.

Some tips to keep in mind:

- When selecting an RV, research the expected maintenance and repair costs and make sure to have money set aside just in case of a significant expense.

- We select the upgrades we do in the van to provide the greatest benefit at the lowest cost. Some of our favorite upgrades have been the least expensive, like motion-activated lights at the base of the sliding door and by the sink. We’ve done all the upgrades on the van ourselves and can’t believe the wealth of resources and how-to videos online.

We have a variety of other costs each month, including our cell phone service, laundry, and personal needs. We spend a lot less on home and body products than we did living in a house, since we go through a lot less shampoo, laundry detergent, cleaning supplies, and toilet paper.

We decided to get a small satellite device at the beginning of the trip and purchased a yearly plan that provides text messages each month and emergency response.

We’ve also spent money over the course of the trip upgrading our backpacking gear. In general, we have less miscellaneous expenses than we did at home, as we aren’t tempted to shop for things we don’t need since we don’t have space in the van for more clothes or possessions.

However, miscellaneous needs will vary greatly depending on the individual and type of RV.

Real-Life Example of Full-Time RVing Costs

To provide a clearer picture of the costs of RVing, here are our average expenses for a typical month in our Revel van:

It is worth noting that we spent some money upfront getting our Winnebago Revel ready to go. We spent about $6,000 on initial upgrades, including adding a cargo box, more solar panels, expedition front bumper, storage for our bicycles, bench seat cover, and black-out curtains. We also bought a variety of storage containers and kitchen items, like pots for our induction stove and sturdy dishes.

Final Thoughts on Budgeting for Full-Time RVing

To minimize these costs, we did a lot of things ourselves and focused on utility first. For example, the bike rack that we added in the van garage only cost about $50 in materials. We tried to focus on what we needed most and not get too caught up in all the ways you can spend money outfitting a van with custom products. In addition, we borrowed a number of items from what we already had in our house, like kitchen utensils, tools, and clothing.

One thing that we were surprised to realize when living in an RV compared to a sticks-and-bricks home was how the small expenses of a traditional lifestyle add up - from drinks and meals out to shopping sprees for clothing or home goods. We’ve met a lot of other full-timers on the road who say they didn’t realize how much unnecessary spending they did until they lived in an RV.

This budgeting exercise and thinking about how you plan to travel will also help inform the type of RV that is best for you. For example, if you pick a larger RV, you’ll spend more on fuel and likely end up staying at more established campgrounds and RV parks. This trade-off might be worth it to you for the comfort of a bigger space, and you could choose to save in other ways, like cooking more meals in.

We’ve been pleasantly surprised to find the costs of full-time RVing in our Revel are even lower than we had anticipated when we started planning the trip. We’ve met a variety of people on the road who make full-time life work for them, some taking time off from work like us and others working remotely.

Working on the road can make RV travel much more doable for a longer amount of time, especially if your work provides health insurance, our most significant expense. For us, we decided we’d rather just travel for fifteen months and be unencumbered by any responsibilities.

Overall, we believe full or part-time RVing is more attainable than most people think. It just requires planning and tailoring your lifestyle to fit within your means.

Comments

Comments on this post are moderated, so they will not appear instantly. All relevant questions and helpful notes are welcome! If you have a service inquiry or question related to your RV, please reach out to the customer care team directly using the phone numbers or contact form on this page .